To proportionally divide amounts owed by the buyer and the seller at closing.

Prorate

Processing

Private Mortgage insurance

Principal

Prime Rate

Primary Residence

Primary Mortgage Market

Pre-Qualification

Pre-Payment Penalty

Prepayment

The preparation of a mortgage loan application and supporting documentation for consideration by a lender or insurer.

Insurance coverage that many lenders, investors, and government agencies require the borrower to obtain to protect the lender against loss in event of a mortgage default for higher LTV mortgages.

The remaining balance due on a debt, exclusive of accrued interest.

The interest rate designated by a lender as its prime rate and which serves as a basis for the

interest rate charged to certain customers.

A residence which the borrower intends to occupy as the principal residence.

Lenders making mortgage loans directly to borrower’s such as savings and loan association, commercial banks and mortgage companies. These lenders sometimes sell their mortgages into the secondary mortgage markets such as FNMA of GNMA, etc.

Tentative establishment of a borrower¹s qualification for a mortgage loan amount of a specific amount or ability to make monthly payments at a certain level, based solely on debt-to-income ratios. Pre-qualification is an estimate only is subject to debt and income verification, credit history, property appraisal and other factors.

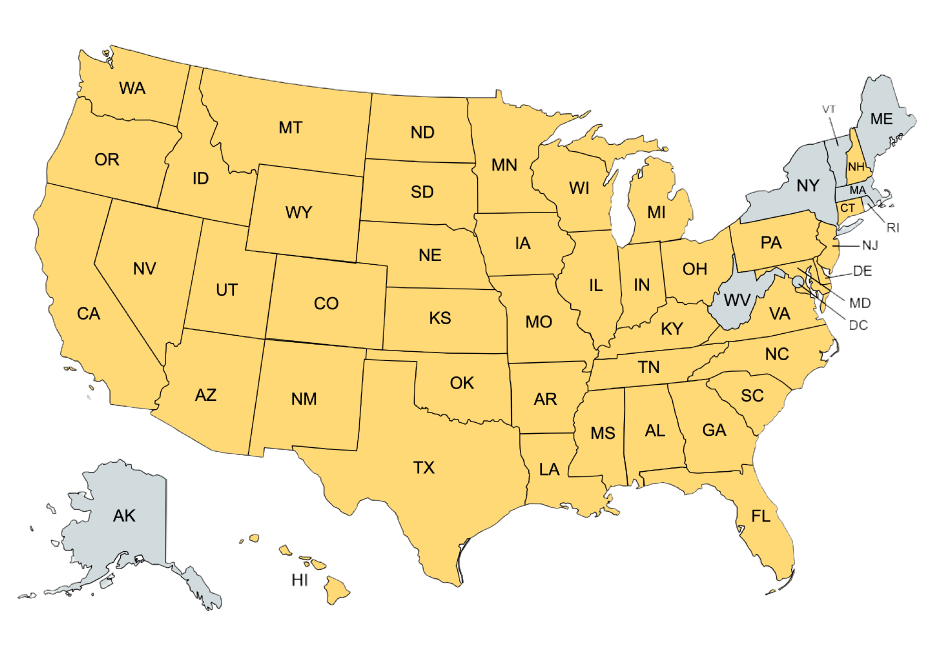

Money charged for an early repayment of debt. Prepayment penalties are allowed in some form in 36 states and the District of Columbia.

Payment of mortgage loan, or part of it, before due date. Mortgage agreements often restrict the right of prepayment either by limiting the amount that can be prepaid in any one year or charging a penalty for prepayment. The Federal Housing Administration does not permit such restrictions in FHA insured mortgages.