Is a USDA loan right for you?

The USDA Mortgage is meant to spur homeownership in pre-designated rural and underdeveloped areas. Take advantage of a 0% down-payment with this program!

These are government-backed mortgages offered by the U.S. Department of Agriculture, designed for low-to-moderate-income borrowers in eligible rural and suburban areas.

Benefits of a USDA loan

- 100% financing: That’s right! This program offers 100% financing for qualifying members.

- First time buyer friendly: USDA Rural Loans can be used by first-time buyers and repeat home buyers alike.

- No homeowner counseling required: Unlike some other mortgage programs, the USDA program doesn’t require a homeowner counseling course to qualify.

USDA loan eligibility requirements

- Ability to prove creditworthiness, typically with a credit score of at least 640

- Stable and dependable income

- A willingness to repay the mortgage – generally 12 months of no late payments or collections

- Adjusted household income is equal to or less than 115% of the area median income

- Property serves as the primary residence

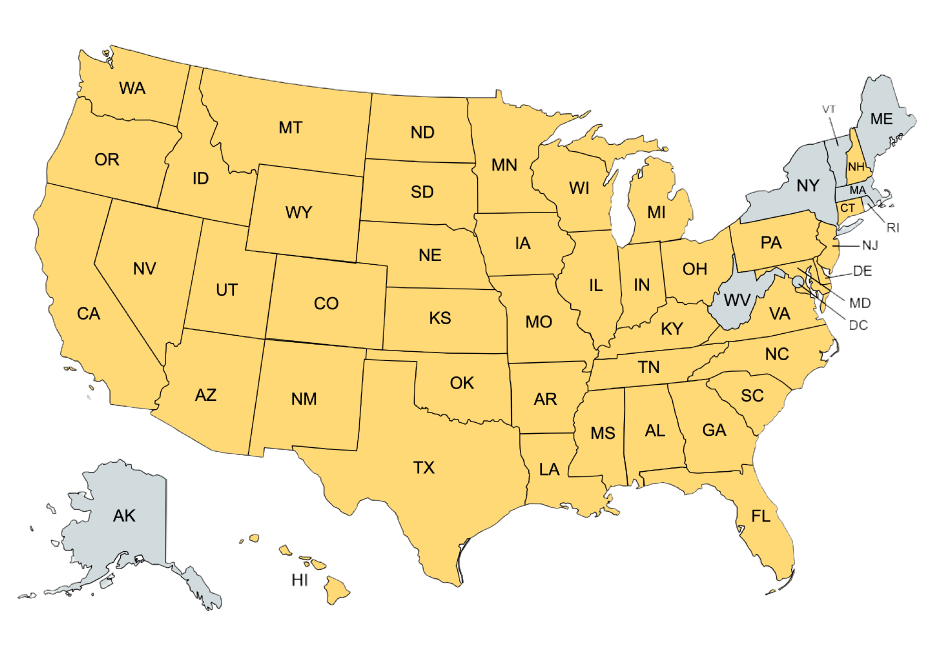

- Property is located in a qualified rural area